|

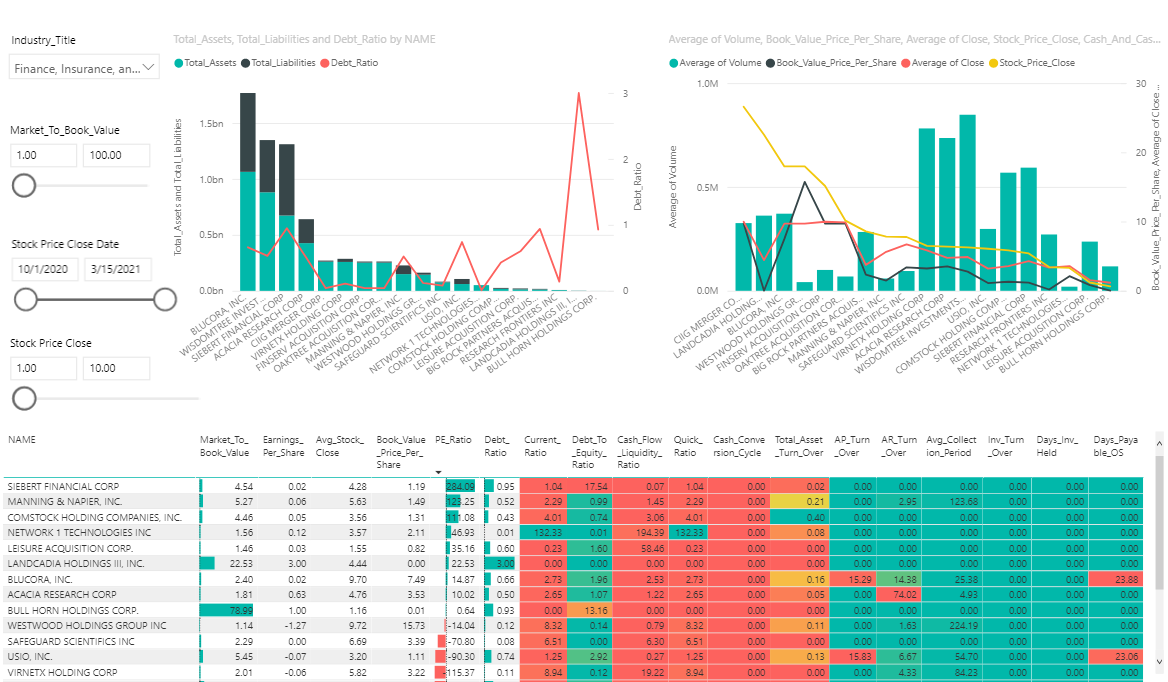

Finance, Insurance, and Real Estate industry stock prices as of 3/15/2021 are higher than the average stock price since the start of Q42020. Market-to-book values for many firms within the industry are trading under 3x, including Network 1 Technology INC ($NTIP) and Acacia Research Corp ($ACTG), both of which are also generating positive EPS(Earnings Per Share) for investors. The M/B ratio compares a company’s market value to its book value. The market value of a company is its share price multiplied by the number of shares outstanding. The book value is the net assets of the company. A lower M/B ratio could mean stocks are undervalued. However, it could also mean something is fundamentally wrong with the company. The P/B ratio also indicates whether you’re paying too much for what would remain if the company went bankrupt immediately. The P/B ratio has been favored by value investors for decades and is widely used by market analysts. Traditionally any value under 1 is considered a good P/B for value investors, indicating a potentially undervalued stock. However, value investors may often consider stocks with a P/B value under 3 as their benchmark. What counts as a “good” price-to-book ratio will depend on the industry in question and the overall state of valuations in the market. For example, between 2010 and 2020 there was a steady rise in the average price-to-book ratio of the technology companies listed on the Nasdaq stock exchange, roughly tripling during that period. An investor assessing the price-to-book ratio of one of these technology companies might therefore choose to accept a higher average price-to-book ratio, as compared to an investor looking at a company in a more traditional industry in which lower price-to-book ratios are the norm.

Example: Assume that a company has $100 million in assets on the balance sheet and $75 million in liabilities. The book value of that company would be calculated simply as $25 million ($100M - $75M). If there are 10 million shares outstanding, each share would represent $2.50 of book value. If the share price is $5, then the P/B ratio would be 2x (5 / 2.50). This illustrates that the market price is valued at twice its book value. Please also connect with our social media pages for future market opinions, picks, and insights. Twitter @SECReporting LinkedIn @SECReportingAnalytics Access SEC Reporting Analytics dataset on Snowflake today to perform your own analysis and insights to share with us here on our community page. Credit: SEC Reporting Analytics Investopedia

0 Comments

Leave a Reply. |

DATA Community NewsResearch & Development FAQs Archives

December 2021

Categories |

SEC REPORTING ANALYTICS 2016-2023 COPYRIGHT ALL RIGHTS RESERVED. All parties receiving or reviewing this website and analytics information provided by SEC Reporting Analytics LLC agree information will be kept strictly confidential, will not be shared with any 3rd party, and will not be replicated in attempts to compete with creator of original content.

RSS Feed

RSS Feed